Our investment philosophy

Investing

“I was feeling dissatisfied with my financial position because I felt that I did not have a good overview of my position nor was my position being monitored by an expert … Alison and her company provide me with a range of information from a very informative website to prompt face to face meetings.

I have every confidence that Alison and Lyfords will continue to meet my need for independent high financial advice, be transparent in their dealings with me, and be professional in their approach to their work, which is helping me meet my financial goals.”

Evidence based approach to investing using financial science

Evidence and experience

We have adopted a reliable evidence based (academically proven), lower cost approach to investing.

Studies such as Fama[1] & French (2010 Journal of Finance)[2] where they looked at 3,156 US equity mutual fund results from 1984 to 2006 have shown that there is no evidence that trying to outguess market prices adds value. Their research showed that stock picking is too inconsistent and unpredictable to be a reasonable method of beating the share market.

Over time we have become increasingly disappointed with active fund managers not being able to consistently outperform market returns, net of their fees.

Philosophy

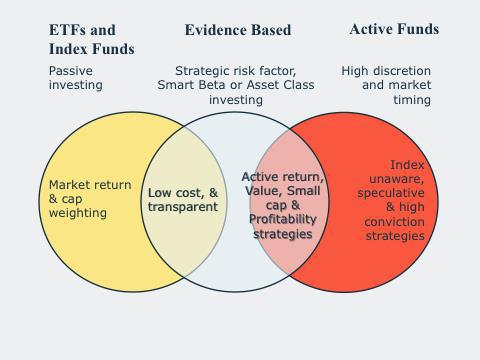

There are two main camps of investing: “Passive” and “Active”.

“Passive” is where you agnostically pick the market via an Index fund.

For example, a passive fund that covered the NZ share market would include all listed NZ shares in the percentages that represented their market value. Basically, in a passive fund you are buying the market. The market return is referred to as getting a “Beta return”. Buying the market is a low-cost approach.

“Active” is where fund managers use their expertise and research to select companies that are considered to be likely to outperform the average return of the share market. They might do this by analysing company accounts, company site visits etc.

This is a high cost approach. Getting a return greater than a Beta return is referred to as adding value or adding “Alpha”. This used to make sense but now with the Internet a most of this propriety information is readily available and reflected in the share price.

In 2012 Fama & French confirmed Fama’s earlier work on his ‘efficient market hypothesis’ which states that asset prices fully reflect all available information.

A direct implication of their research is that it is impossible to “beat the market” consistently on a risk-adjusted basis. This is because market prices should only react to new information which is reflected in the price.

“Active management is a zero sum game, and that’s before costs. That’s not opinion. That’s maths.”

Eugene Fama, Nobel Laureate 2013

“Smart Beta approach

This approach has the advantages of investing “passively”; primarily diversification and low costs, as well as some of the advantages of “active” investing; namely that the index chosen can be filtered against “factors” or “dimensions”.

The academic research of Fama and French identified the drivers of return. For equities these are; company size (small caps vs large cap), relative price (value vs growth), profitability (high vs low) and capital re-investment.

Effectively, Smart Beta is a rules-based approach and bridges the gap between the low cost passive approach and the high cost active approach.

In 1998 Charles Ellis wrote, ‘Winning the Loser’s Game’, in which he presented evidence that while it is possible to generate alpha and win the game of active management, the odds of doing so are so poor it is not prudent for investors to try.

In his book which is now in it’s eighth edition Ellis demonstrated and explained why it is harder than ever to produce investment results that overcome operating costs and fees. While active investing might be exciting and does provide the possibility of outperformance, the far greater likelihood is that it will lead to underperformance.

The prudent strategy is to invest in low-cost funds that invest systematically (avoiding stock selection and market timing strategies) and that target unique sources of risk (factors), and have the discipline to stay the course. Long term this will provide you with the greatest odds of achieving your financial goals

Investment strategy adopted:

After much due diligence Lyfords adopted a “Smart Beta approach”[3] to constructing investment portfolios. Studies such as those referred to above have shown that active fund managers are not consistently delivering fund out-performance. Their overall fees make for a worst outcome than passive funds.

The key benefits for our clients are:

-

- Greater diversification across markets (over 43 countries and more than 10,000 securities) resulting in lower volatility.

- Lower cost, average portfolio manager expenses of 0.34% vs 1.22% p.a. for a balanced portfolio constructed from active managed funds. Some fund managers may also charge performance and buy/sell fees.

- Peer-reviewed academic evidence based investing.

- The portfolios utilise less trading, lower costs of trading avoiding high fund manager fees.

- An independent custodial platform is used which provides third party compliance and tax efficiencies, security, online access to performance, market summaries and tax reports.

Youtube videos:

For an independent perspective, check out the videos in the section “Why Indexing Investing is Taking Off”.

[1] Eugene Fama, University of Chicago economist, Economic Sciences Nobel Prize winner 2013

[2] Fama-French 1993 “three factor model” of investing and subsequently the Fama-French 2015 “5-Factor model.

[3] Smart Beta Passive Approach has been adopted and refined by organisations such as Dimensional Fund Advisors. Dimensional was founded in 1981 by David Booth and Rex Sinquefield former students of Fama. The Nobel laureates; Eugene Fama, Robert Merton and Kenneth French (of the Fama-French three factor model) are academic consultants to Dimensional Fund Advisors and the Nobel laureate Myron Scholes is one of the independent directors.