Consilium milestone

Consilium recently cracked through the $9 billion in funds under management (FUM) mark, cementing its...

Timeless advice on volatile markets

Investing can sometimes feel like a black hole, pulling in as much time and energy...

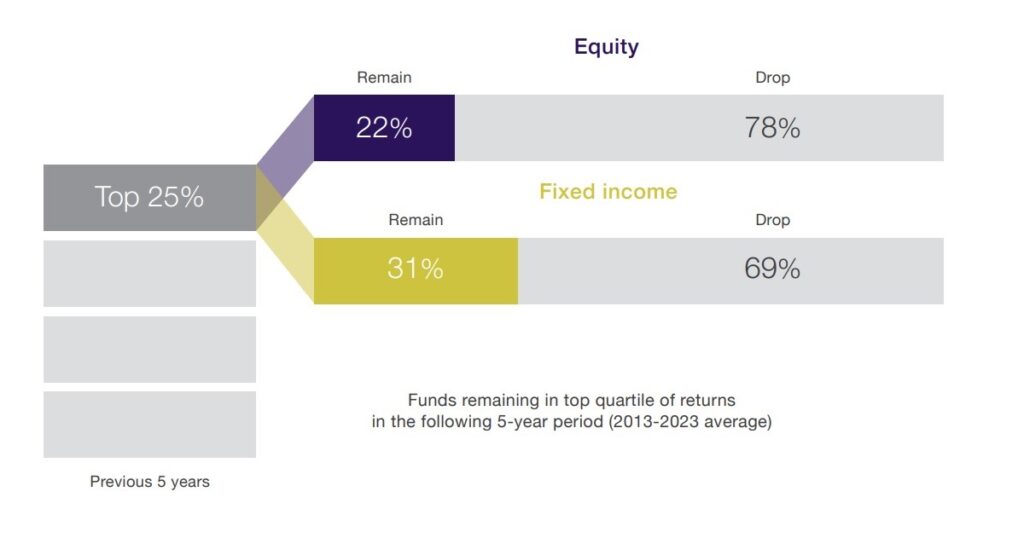

Chasing past performance

The chart shows the percentage of top-ranked funds that remained on top after 5 years. ...

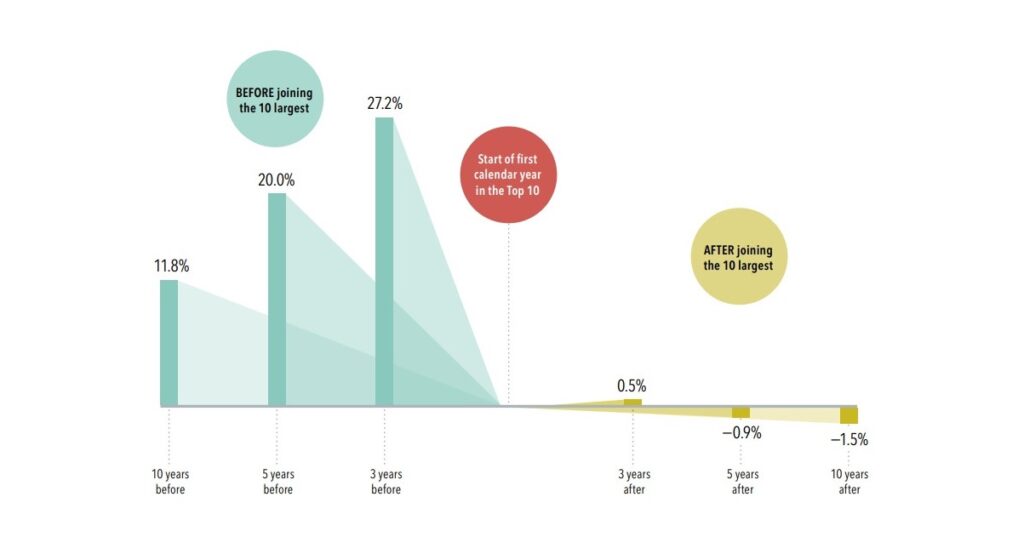

Should you invest in the fastest growing share?

The chart shows the average annualised outperformance of companies before and after they entered the...

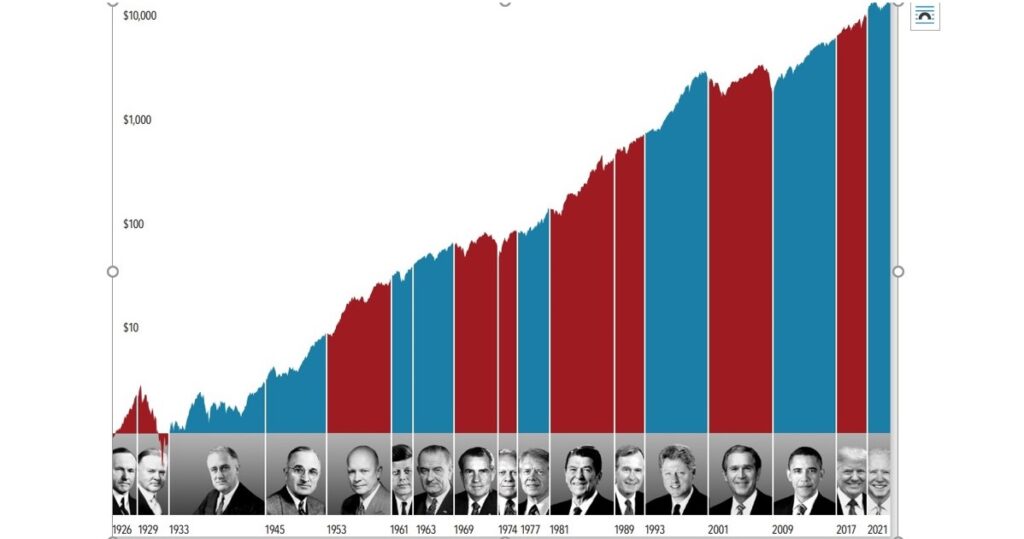

Does a US President really affect share markets?

Looking at the evidence of how US Presidential terms have affected US share markets its...