Responsible investing and ethical funds

Investing

“Sustainable development meets the needs of the present without compromising the ability of future generations to meet their own needs”

World Commission on Environment and Development

Socially responsible investing (SRI), or ethical investments is the broad term used for an investment approach which seeks to consider a company’s broader impact on society, and the environment.

Ethical investing is where you consider not only the returns of the investment but also the implications of ESG (Environmental, Social and Corporate Governance).

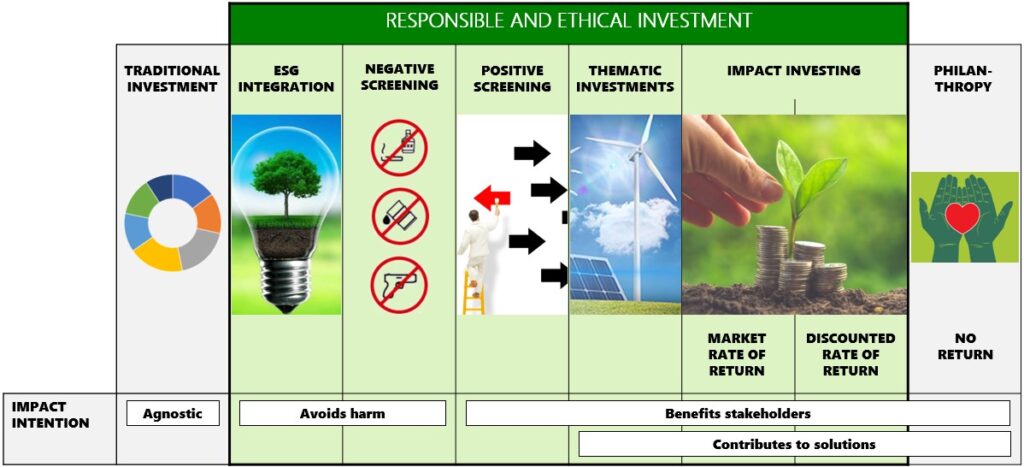

The SRI approach can be implemented on a spectrum ranging from minimal changes to stricter approaches.

The two most common approaches are ‘negative screening’ and ‘positive screening’.

Negative screening

Negative screening seeks to exclude certain companies or industries assessed as having a negative impact on society.

This includes industries with exposure to factory farming, child labour, cluster munitions and landmines, nuclear weapons systems, tobacco, alcohol, gambling and adult entertainment. Generally, companies connected with these issues can be excluded without a significant impact on diversification.

Positive screening

Positive screening is where fund managers will weight portfolios to companies that support, for example, fair-trade agreements, focus on environmentally sustainable practices, or do volunteer work in the community.

To be deemed to be a Socially Responsible Investment (SRI) it needs to also include a focus on shareholder advocacy. It needs to consider whether a company is acting responsibly on a range of environmental, social or governance issues including emissions. This includes both greenhouse gas emissions intensity and potential emissions from oil, coal and gas reserves.

The strategy used by the funds Lyfords recommends include the screening above, and the socially responsible element of corporate governance and the factors that academic evidence have shown to be the drivers of return. The portfolios are aimed at pursuing higher expected returns through increased weightings to securities with smaller market capitalisations, lower relative prices, and higher profitability.

Adopting an SRI approach can lead to slightly lower diversification as the fund universe is smaller and can be especially difficult to implement in emerging market allocations.

Our experience has shown that returns can sometimes be better than mainstream portfolios where an SRI tilt is not applied. Fundamentally it comes down to the industry spread of companies in the portfolio. For example when the NASDAQ is booming we often find SRI portfolios do better as they have a higher tilt to this sector.

Facts around SRI investments

The Global Investment Review 2020 reported that sustainable investments reached US$35.5 trillion in assets under management. This represents 36% of all professionally managed funds worldwide.

Each year the Responsible Investment Association Australasia reports on the SRI sector. The key findings from the 2021 report are:

-

- SRI funds in Australia made up 40% of the total investable funds in 2020, up from 31% in 2019.

- The top three responsible investment approaches for ESG (Environmental, Social, Governance) integration are negative screening, corporate engagement and shareholder action.

- Investment managers are improving accountabilities by better evidencing their claims.

- The exclusion of the fossil fuel sector is important both to the public and fund managers. However the report found negative screening approaches and the expectations of investors do not always align.

- Despite economic set-backs experienced by Covid-19 lockdowns, SRI funds outperformed both international share and multi-sector growth funds in 2020. With an increasing number of fund managers including an SRI approach the differential in fund performance is expected to become smaller

More information and an executive summary of the 2021 RIAA report is available in this link RIAA’s Responsible Investment Benchmark 2021 report