Income Protection Insurance

Insurance

“I have no idea when or if I will ever be able to return to work and am grateful for both the income protection and trauma insurance that my adviser Alison Renfrew had arranged for me. Six months of income protection was paid in advance along with the trauma claim within two weeks of my accident. It made a huge difference to know that I didn’t have any financial worries. If I cannot return to work I will be paid a benefit until I’m 65.”

If you are unable to work due to an accident or an illness an income protection benefit could pay you up to 75% of your pre-disability gross income to age 70.

While you are disabled there will be additional costs relating to your disability.

If you do not have a family to protect you will still need income to replace your earned income if you became unable to work.

Income Protection policies are not all the same; choosing the right one requires you to consider:

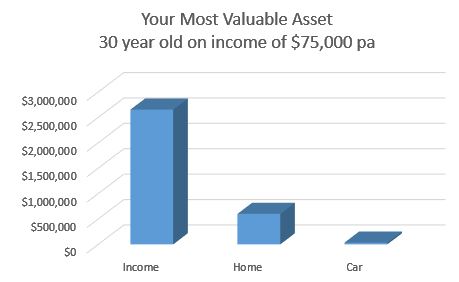

What is your most valuable asset?

If someone asked you what your most valuable asset is you’d probably say it’s your house. But, unless you are retired or close to it, your biggest asset is your ability to earn an income.

Imagine a 30 year old in a world where there is no inflation, to keep the story simple.

She is intending to work until she’s 65 and doesn’t plan to take time out for children. She earns $75,000 p.a. in this inflation-less world where your salary will never increase. Over her working life she will have earned $2,625,000. She has purchased a home for $600,000 and will never buy another one (the home doesn’t increase in value either). She has purchased a car for $30,000 that will never need replacing and will never increase in value. In this simple world where goods don’t increase in value and there’s no inflation her income is worth more than four times her house.

She pays for house and car insurance but says she can’t afford to insure herself even though her ability to earn an income is her most valuable asset.

How long can you afford to self-insure for?

A four week ‘wait’ or self-insurance period is standard. If you choose an eight week wait period your premiums will reduce dramatically. The most cost effective wait period is twelve weeks. If you have generous sick leave provisions in your employment contract you may be able to choose a six month wait period.

A longer wait period means there is much less risk to the insurance company and your premiums will be lower ,BUT if you change your employer you might not have such generous sick leave and you’ll have to apply for a shorter wait period. If you are no longer insurable you’ll be stuck with this longer wait period.

The definitions of terms in the policy document

What is a total disability?

A good definition of total disability in an insurance policy should include that the insured is unable to work for ten hours or more. This means a business owner can visit the office for a few hours each day, give some instructions to staff, check on emails etc. while not being accused of working while on a benefit.

Income protection insurance for business owners

The needs of a business owner are different to employees. Many business owners have insurance that is unlikely to pay a benefit.

Why, because they are unaware that their income protection policy will not pay a benefit if the policy holder is entitled to receive other income from a business. If a business continues to generate income while a shareholder/employee is unable to work the wrong policy to have is one which offsets other income.

Beware. Talk with a specialist insurance adviser about the correct business insurance to have.