The Rise and Fall of Market Darlings: What History Tells Us About Top Stocks

In the world of investing, few things capture attention like a group of superstar stocks dominating the market. Today, we’re talking about the “Magnificent Seven”—Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, NVIDIA, and Tesla. These tech giants have delivered staggering returns in recent years, propelling them to the top of the US market by capitalization. As of late 2025, they account for over a third of the S&P 500’s weight, driving much of the index’s performance.

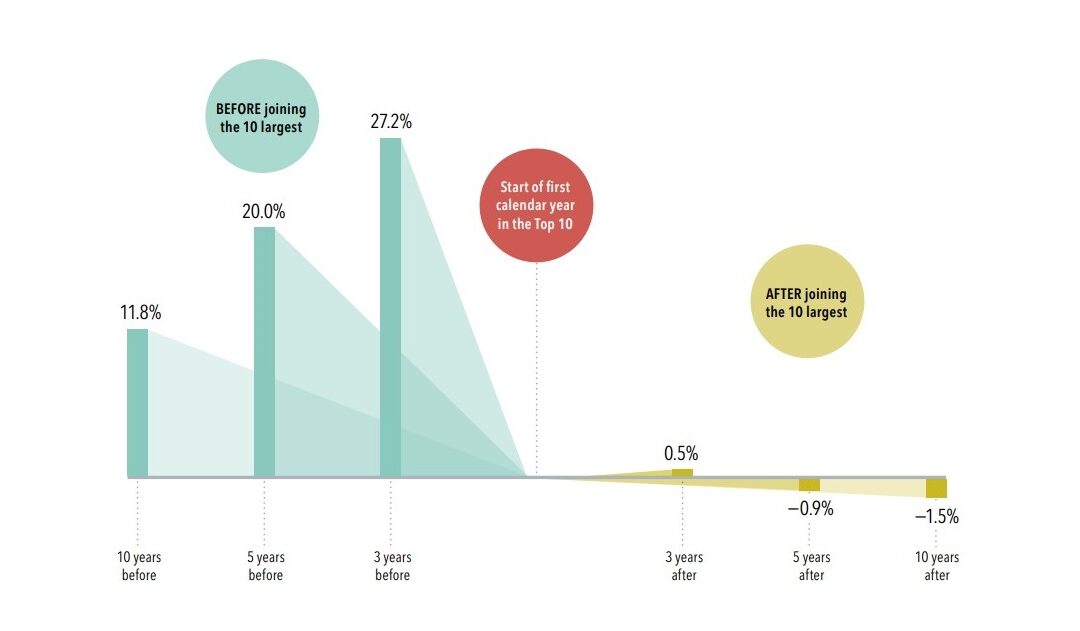

But history offers a sobering reminder: once companies crack the Top 10 largest stocks, their glory days often fade. A long-term study of US market data from 1927 to 2023 (using the Fama/French Total US Market Research Index) reveals a clear pattern. Stocks that enter the Top 10 by market cap tend to massively outperform in the years leading up to that milestone—but lag the broader market afterward.

The Data: Outperformance Before, Underperformance After

Here’s the key insight from nearly a century of data:

-

-

-

- Three years prior to entering the Top 10: These future giants delivered average annualized returns **more than 25% higher** than the overall market. That’s the rocket fuel of momentum—positive news, innovation, and investor excitement pushing prices skyward.

- Five years after joining the Top 10: On average, they began **underperforming** the market.

- Ten years after: The gap widened further, with these once-hot stocks trailing the broader index even more.

-

-

This isn’t just a recent phenomenon tied to tech bubbles. It spans decades, from industrial eras to the dot-com boom and beyond. The pattern holds because stock prices reflect expectations. When a company surges into the elite ranks, much of the good news is already priced in.

Why Does This Happen? Mean Reversion in Action

This behavior is a classic example of **mean reversion**—the tendency for extreme performance to normalize over time. Exceptional growth can’t last forever. Reasons include:

-

-

-

- Scaling challenges: As companies grow massive (trillions in market cap), maintaining hyper-growth becomes harder. Doubling revenue is tougher at $500 billion than at $50 billion.

- Increased competition and regulation: Top dogs attract scrutiny—from antitrust probes to rivals gunning for market share.

- Valuation stretch: High expectations baked into prices leave little room for error. Any slowdown triggers sharp corrections.

- Market dynamics: Broader opportunities emerge elsewhere. While giants mature, smaller or undervalued companies catch fire.

-

-

Historical parallels abound. Think of the Nifty Fifty in the 1970s—blue-chip growth stocks that dominated until they crashed. Or the dot-com leaders like Cisco and Intel, which soared in the late 1990s but lagged for years after.

Lessons for Today’s Magnificent Seven

The Mag 7 have been magnificent indeed, fueled by AI, cloud computing, and digital dominance. But apply the historical lens:

-

-

-

- Their explosive run-up mirrors the pre-Top 10 outperformance phase.

- Now firmly entrenched (all in the global Top 10), the data suggests caution. Sustaining 25%+ annual edges over the market indefinitely defies gravity.

-

-

Of course, this group is exceptional—strong fundamentals, massive cash flows, and secular tailwinds like AI. They may outperform longer than average. But history warns against assuming eternal dominance.

What Should Investors Do?

- Diversify: Concentrating in a handful of mega-caps amplifies risk if leadership rotates.

- Stay disciplined: Chasing recent winners often means buying high.

- Focus on the long term: Broad market exposure captures the next wave of outperformers.

- Remember valuations matter: High prices demand flawless execution.

Disclaimer: Past performance is no guarantee of future returns. This is not investment advice—markets are unpredictable, and individual circumstances vary. Always consult a financial professional.

In investing, as in life, what goes up exceptionally fast often comes back to earth. The Top 10 throne is prestigious, but it’s rarely a permanent seat.