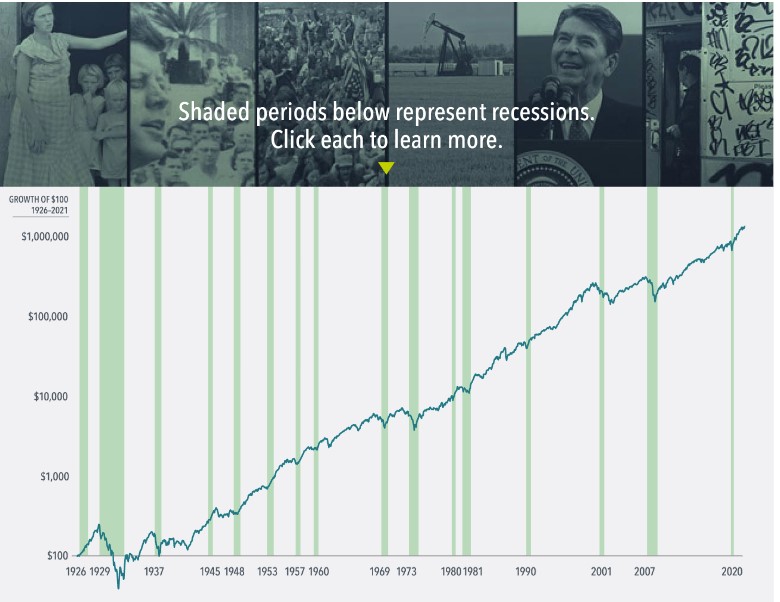

Lessons from history

What does history tell us about share market returns after a period of economic recession?

Below is an interactive article from Dimensional Fund Advisors. It shows how the US share market has behaved during economic downturns. Share markets around the world have often rewarded investors even when economic activity has slowed. This is an important lesson on the forward looking nature of markets.

Please click on the image and this will download an interactive pdf document. There is a lot of data and information in this document.

You can either page down or click on the green bar on the graph to be taken to a summary of each recession.

The key message is, recessions do not last and share markets reward patience.

What does history tell us?

The table below summarises the returns after major share market corrections.

Our blog How the Dow Jones Index has performed over 120 years looks at how the peaks and troughs have reflected the U.S. economy’s triumphs and tribulations over this 120 year period.

Be greedy when others are fearful

The famous investing philosophy to be fearful when others are greedy, and greedy when others are fearful comes from the king of wise investors, Warren Buffet (Berkshire Hathaway).

Our economy will recover and collapse time and time again, that is for certain. What isn’t for certain is whether you will keep a clear head through it all and stay the wise investor.

Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful, but good diversification can ensure success long term.