Written by: Richard W Renfrew (Financial Adviser)

Signs Pointing to a Bubble

- Valuation Surge: AI-related companies have seen valuations skyrocket, often far beyond their current earnings or proven business models.

- Speculative Spending: Trillions are being poured into AI infrastructure and CapEx, even by firms that may need to borrow to fund it.

- Investor Sentiment: A Bank of America survey found that 54% of investors believe AI assets are already in bubble territory.

- Dot-Com Parallels: Many experts compare this moment to the late-1990s dot-com boom—where hype outpaced fundamentals.

But Not Everyone Agrees

- Long-Term Optimism: Nokia’s CEO, for instance, likens the AI surge to the Internet revolution, suggesting we are at the beginning of a long-term growth cycle.

- Tech Fundamentals: Some argue that AI is a foundational shift—like electricity or the Internet—and that current valuations reflect future potential, not just hype.

Key Differences Between the AI Boom and the Dot-Com Bubble

- Revenue: Many companies had no revenue back in 1999/2000, just a website. Most AI companies (eg., Microsoft, Nvidia, Apple, Tesla, Alphabet) are profitable.

- Debt levels: The capital structure of many dot-com companies was fuelled by debt. Most AI companies are cash-rich and funding development internally.

- Cash reserves: The major tech companies at 3Q 2025 are sitting on high cash reserves: in USD, Tesla $40 billion, Nvidia $55 billion, Microsoft $95 billion, Apple $55 billion, Alphabet $99 billion.

- Mature: In 1999, the Internet was just emerging. Today’s AI is built on mature cloud data and servers.

- Speculation: The dot-com boom was fuelled by speculative IPOs in a very short period. There are fewer AI company IPOs now and more consolidation.

- Tangible benefits: In 1999, there were many vague promises. Today, there are tangible applications in productivity, healthcare, etc.

- Institutional Investors: In 1999, the bubble was driven by retail mania. Today, institutional investors dominate.

Our Philosophy

Earnings multiples are currently extremely high for big tech companies like Openai and Tesla, reminiscent of the 2000 tech bubble. While some analysts believe these valuations are justified by efficiency gains, the verdict is still uncertain. A long-term investment approach suggests staying invested, but that may not feel reassuring.

Personally, I believe AI is easily replicable so big tech companies might receive significant cuts in their valuations, but the advantages from AI will come through to smaller companies. These smaller companies don’t have such high earnings multiples as the big tech ones and might be in a position where they can grow, improve faster, and increase their earnings multiples faster by embracing AI.

Our investment portfolios have a tilt towards smaller companies, more profitable companies, and companies with better balance sheets. This investment tilt makes our investment portfolios a little bit more resilient to the current higher valuations.

Are share markets really different today?

If you have a look at the S&P500 index over the last 40 years (logarithmic scale) the current market returns are not far out-of-line. The S&P500 index averaged 9.7%pa over this period.

S&P500 Index over the last 40 years

Earnings multiples are high with some large tech companies and this could look similar to the tech bubble of 2000. While this is true, other analysts might also be right, in that the earnings are justified based on efficiency improvements. The verdict is not clear.

A prudent investment philosophy would be to invest anyway because you’re investing for the long haul.

Our investment portfolios have a tilt towards smaller companies, more profitable companies, and companies with better balance sheets. This investment tilt makes our portfolios a little bit more resilient to the current higher valuations.

Markets are not predictable (except in retrospect). Our portfolios are well diversified. If you are concerned then we could pull back your risk-return profile.

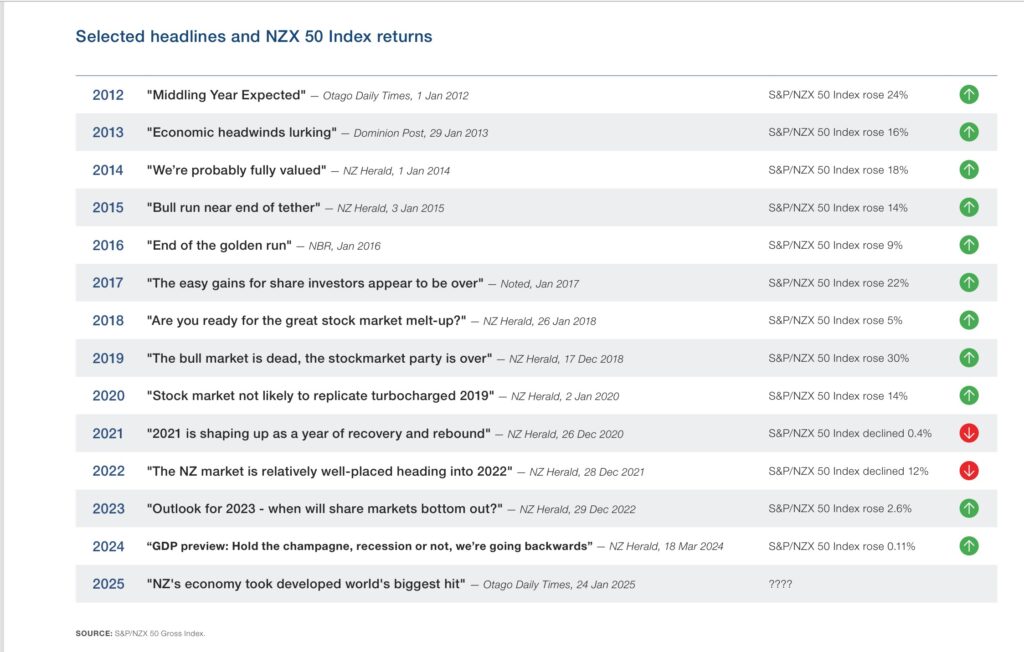

The slide below is interesting. This compares local newspaper headlines and the NZ share market returns over the following 12 months. The NZ share market did almost the opposite of what the newspaper headlines were predicting.