It’s the question we get asked more than any other (at barbecues, school pick-ups, and yes, even in the office):

“Is now a good time to invest?”

With global and New Zealand sharemarkets regularly hitting all-time highs in 2025, it’s completely understandable to feel nervous about “buying at the top”. Nobody wants to invest today only to see prices drop 10% next month.

So let’s look at what almost 100 years of hard data actually tells us.

What happens when you invest at an all-time high?

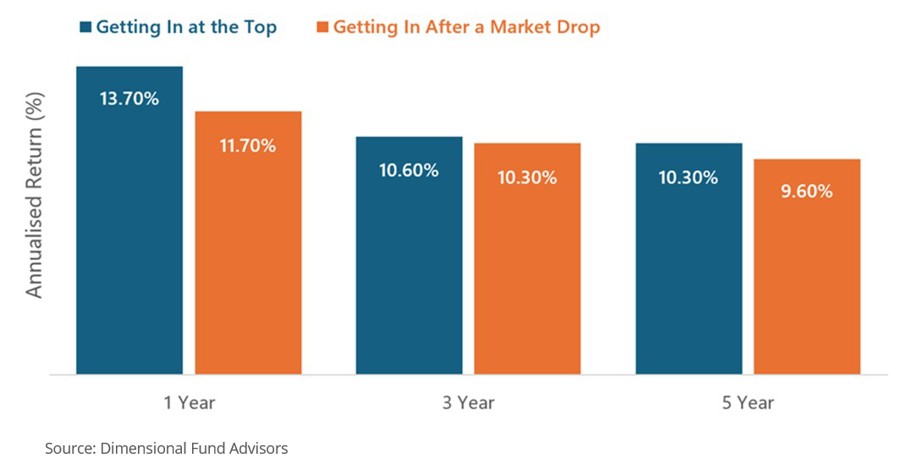

A comprehensive study of the U.S. S&P 500 (a reasonable proxy for global shares) compared two simple strategies over 98 years (1926–2024):

-

- Invest immediately when the market hits an all-time high (“buying at the top”).

- Wait for a 10% market correction before investing.

Here’s what the average returns looked like over 98 years between 1926 and 2024:

Surprising, isn’t it? Even when you invest on the very day the market hits a record high, you still come out ahead on average compared with waiting for a pull-back.

Why? Because markets spend far more time going up than going down. Today’s “all-time high” is usually tomorrow’s launching pad for the next all-time high.

The real enemy? Human behaviour (and headlines)

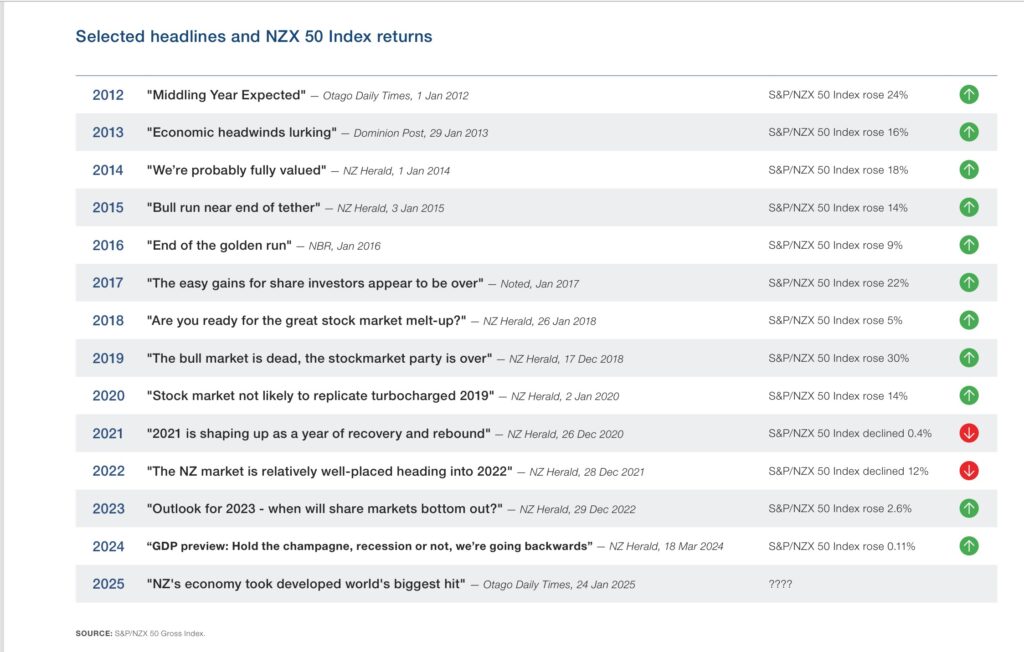

Trying to time the market is incredibly tempting, especially when headlines are screaming doom and gloom. But New Zealand history shows just how unreliable forecasts can be:

The pattern is clear: even the “experts” get it wrong more often than they get it right.

Investors who wait for the perfect moment often watch the market climb 15–20% while they sit in cash. When the eventual dip finally arrives, the news feels terrifying, so they wait longer… and then miss the recovery altogether.

There has never been a bad 30-year starting point

If you’re investing for the long term (think KiwiSaver, retirement, or leaving something for the kids), short-term wobbles matter far less than you think.

Every rolling 30-year period in the S&P 500 since the 1930s has delivered a positive real return — even if you started investing the month before the Great Depression or just before the 1970s oil shocks and stagflation.

For a New Zealander retiring around age 65, 30 years is a very realistic investment horizon. History says time in the market beats timing the market — every single time.

So… is now the right time to invest?

For anyone with a long-term horizon (5+ years, and ideally 10–30 years), the answer is almost always:

Yes — because waiting for the “perfect” time usually costs you more than any correction ever would.

As the legendary fund manager Peter Lynch of Fidelity Investments (US) famously said:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

At Lyfords, we don’t try to predict the unpredictable. Instead, we help you build a diversified, low-cost portfolio that matches your goals and risk tolerance — and then we keep you invested through the inevitable ups and downs.

If you’ve been sitting on cash waiting for a dip that may never come, perhaps it’s time for a chat. Also have a read of our blog What is that Bank Term Deposit Really Costing You?

Past performance is not a reliable indicator of future results. The value of investments can go down as well as up. Please ensure investments align with your personal risk profile and objectives.