Have you considered how much money you are losing by having your money in term deposits?

Over the last 10-years ending December 2024 the average return on a 6-month bank term deposit in New Zealand was 3.3% per year. That’s 3.3% before tax and inflation.

Over the same period money invested in a balance diversified portfolio of 50% growth and 50% income funds earned 6.9% per year before tax, fees and inflation.

What was your real return?

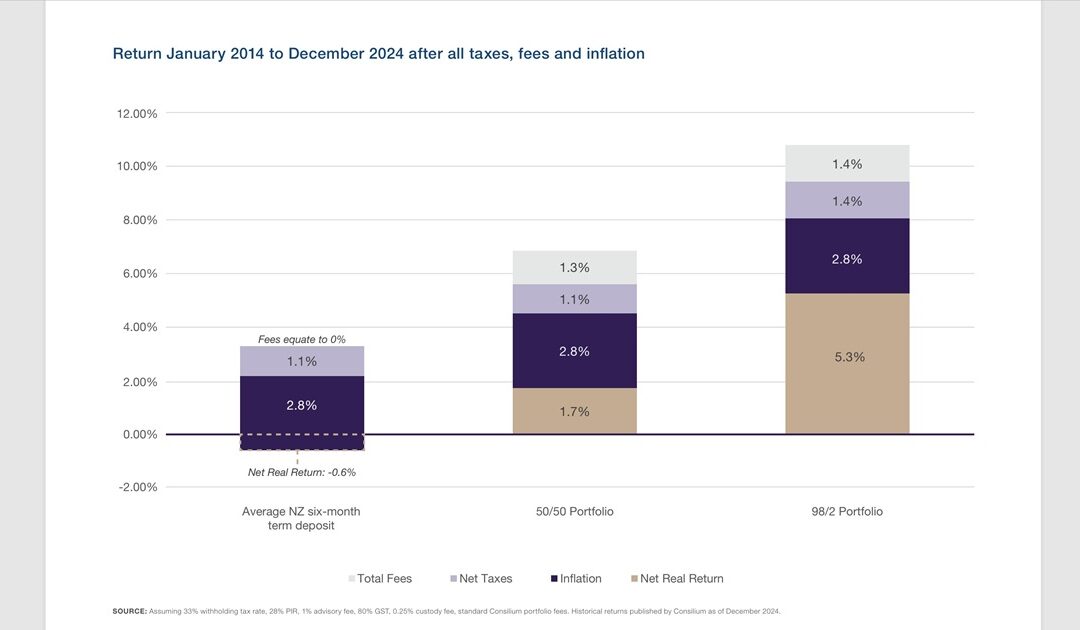

Have a look at the graph above.

For the 6-month bank term deposit, taking off the tax at 33% of 1.1% and inflation which averaged 2.8% over this period, then the actual return was negative 0.6% (-0.6%) per year.

For the 50-50 portfolio (PIE Funds) take off fees of 1.3%, tax of 1.1%, inflation of 2.8% the net return was 1.7% per year. For the 98/2 portfolio the net return averaged 5.3% per year.

Let’s translate this to real money

Consider a client with $400,000 in a term deposit. Over the 10-year period they have effectively lost $23,328 in purchasing power because of inflation, even though they earned $153,431 in interest.

Now if they had invested the $400,000 in a diversified balanced portfolio 50-50, the real purchasing power of their money would have increased by $73,445 and they would have had a total return of $221,188.

The balanced portfolio not only earned more (+$67,757 extra return), but preserved and grew real wealth, while the term deposit lost purchasing power even though interest was earned.

In summary:

- Term Deposit

- Interest Earned: $153,431

- Change in Purchasing Power: -$23,328 (loss due to inflation)

- Balanced Portfolio (50-50)

- Total Return: $221,188

- Change in Purchasing Power: +$73,445 (gain after inflation)

That’s a difference of $96,773 – do you still think it’s a good idea to keep your long term savings in fixed interest?

But what about the share markets going up and down?

During this 10-year period January 2014 to December 2024 the S&P500 (top 500 shares in the US share market) went up 337%. This is even taking into account the fall of 19.7% in March/April 2020 (Covid 19), the 25.7% correction between November 2021 and October 2022 (due to the rapid rise in interest rates by World banks to counter the effect of inflation).

These large falls in the S&P500 Index might sound scary, but please note our portfolios are diversified across different geographic and asset classes. They are not 100% in shares. Unless you are a particularly aggressive investor and have requested this.