Beware of the hidden fees charged by banks

While banks often disclose for overseas money transfers a transaction fee, what is not disclosed is the exchange rate margin that is used. This is the hidden fee.

The exchange rate margin used by banks can be as high as 2 to 5%. This is the hidden fee and is the rate that say a money transfer service like XE use and the rate the bank or credit card companies use.

New Zealanders are paying around $1.6 billion in extra fees compared with what the same Australian banks operating in New Zealand are charging their clients in Australia. While this is legal it seems immoral to be taking such a high margin without disclosing their hidden fees.

The stuff.co.nz web site ran an article on 2 June 2022 on hidden bank fees.

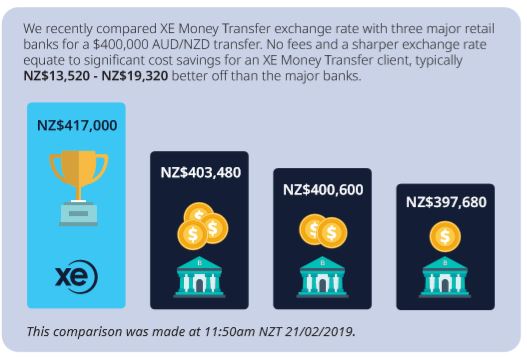

See the difference the fees can make:

Solution

LYFORDS has partnered with New Zealand’s largest specialist provider of foreign exchange, HiFX Limited which provides the XE Money Transfer service.

The XE Money Transfer service offers an easy, quick and affordable way for both individuals and businesses to avoid the usual hassle, expense, and complications of international transfers. The rates used are more inline with wholesale rates and better than you can access as a retail investor from your bank. Using the XE Money Transfer service you will be able to send, track and manage international money transfers anytime and anywhere from your mobile, tablet or desktop.

XE help you keep more of your money with fee free transfers and bank-beating exchange rates. They regularly check the main high street banks to make sure the overall price is better. They also monitor markets to let you know if the rate you want has been reached. Plus, XE can check the status of your transfers 24/7, and keep you and your recipient updated along the way.

If you are an existing client of Lyfords please contact us and we can organise XE to contact you and get an account set-up.