What do you need to consider?

Updated February 2023

There are over 48,000 residents in over 450 retirement villages in New Zealand. The number is increasing each year with our aging population. This is big business and is very profitable.

The six largest Retirement Village operators – Ryman, Metlifecare, Summerset, Bupa, Oceania, and Arvida are significant players in the New Zealand Retirement Village market. Between them they have an estimated 43% of villages throughout the country. The larger than average size of these retirement village operators means that they account for 60% of national numbers.

Their offers vary depending on:

-

- Minimum age of entry

- The Deferred Management Fee (DMF) calculation

- Weekly fees

- Shared capital gains or not

- One or two DMF’s

- Weekly entertainment

- Care onsite – none, partial or full continuum of care

- License to Occupy (LTO) prices ranging from $200,000 to $4 million+

What are the costs?

Buying into a retirement village is a very similar cost to buying a house; $200,000 to $4M. Occupants are effectively giving the retirement village an interest free loan and giving up capital growth.

The minimum entry age varies between 70 to 75 with the average occupancy of 7.1 years due either to death or moving into full time care.

The retiree has a life time occupancy but not a title and therefore is unable to use the asset to fund say a reverse mortgage.

Beware of promises of future facilities, get this in writing. Make sure you both sign the documents. If only one of you signs and the older partner dies, the younger partner may be below the minimum age and be required to move out at the discounted price.

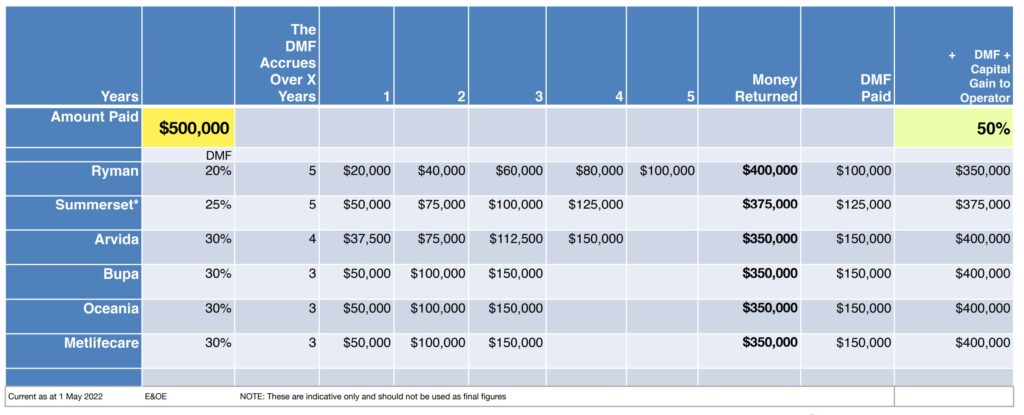

The table below compares the costs against each operator (date 1 May 2022) for an initial $500,000 License to Occupy.

The above table shows if you paid $500,000 for your retirement village home for the first 3-5 years the deferred management fee accumulates.

For example, for Ryman Healthcare each year there is a charge against your property of $20,000. By year 5 a total deferred management fee of $100,000 has accumulated. If you died or moved out this is offset against your initial outlay of $500,000. You will get back $400,000.

In addition to the deferred management fee the operator normally keeps the capital gain. For example, in the case of Ryman if properties grew by 8.5%pa over this 5 year period the operator keeps the capital gain of $250,000. Plus the deferred management fee of $100,000.

What if you need to sell?

If for whatever reason you need to sell your unit, you may find it can take a long time to find a buyer. For example, if one of you needs to move into full time care and you are not able to afford the overall costs, you may need to sell your retirement village home.

Retirement Village Residents’ Association says 71% of its members’ units that were vacated in 2019 had new Occupation Right Agreement (ORA) sold within six months, 26% took longer, but just 3% were unsold after a year. This is the case reported by Stuff.co.nz in their article of 21 September 2022. In this article the 80 year old woman had vacated her village residence 10 months ago and remained liable to pay weekly management fees to the village operator until it sold a new ORA on the unit she had vacated.

The Sunday Star Times published a very good article on 5 February 2023 titled “I just don’t know why I did it. Our oldest population is losing money, by buying into retirement villages“. In spite of the title it’s not all negative. Residents share stories about their experiences with retirement villages and their reasons for moving into the villages. The major theme is a discussion around the occupation rights agreement (OCR) model.

For a summary and the questions you should be asking before making a decision which retirement village to go into, please read this Retirement Village Guide.

Additional Resources:

-

- Aged Advisor NZ – website and magazine www.agedadvisor.nz

- Retirement Village Residents’ Association www.rvr.org.nz

- Retirement Commission

- Aged Concern

- Grey Power

- SeniorLine