SPIVA (Standard & Poors Index vs Active) research is a very extensive study looking at the performance of active fund managers against their relative index benchmarks worldwide.

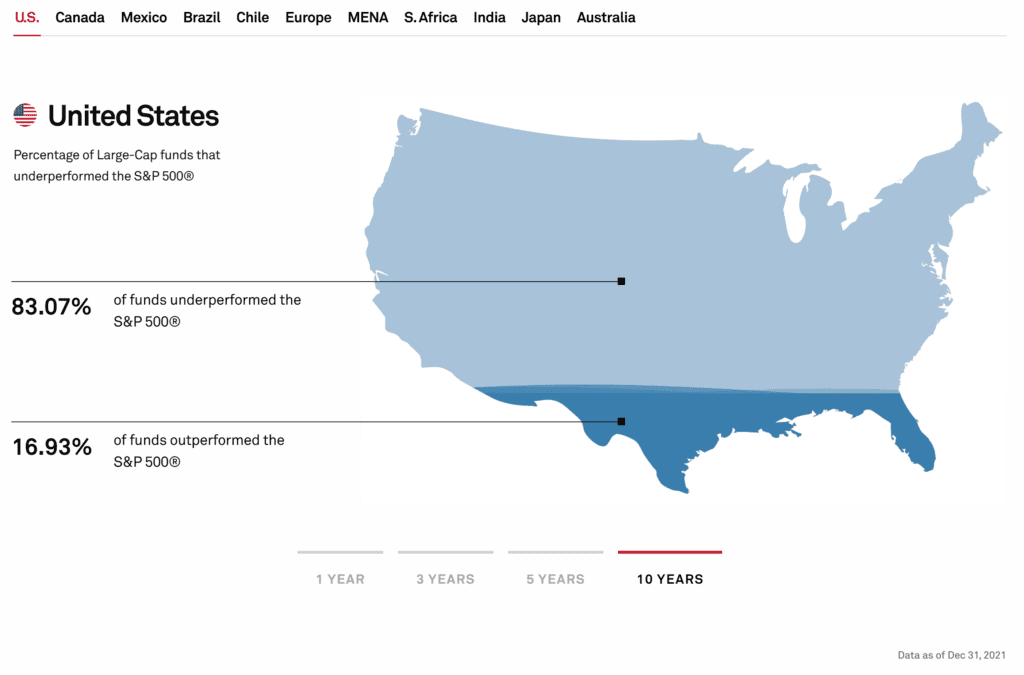

Across many markets the results are similar to the US summary below. Around 80% of active managers fail to consistently outperform the relevant benchmark over 1 and 10 years. The story is slightly better over the 3 and 5 year marks, 68% and 73% respectively underperform.

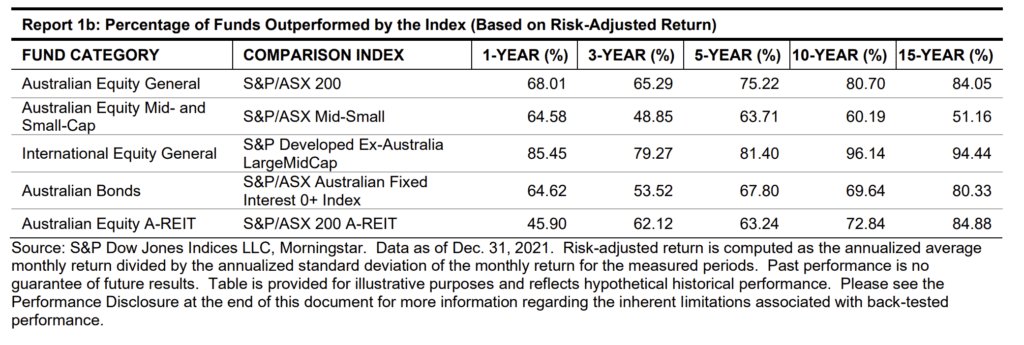

Even when you break it down into the underlying sectors, for example for the Australian market the story is similar, most active managers cannot consistently outperform their relevant index.

There is further information on our web page Why index investing is taking off.