Investing can sometimes feel like a black hole, pulling in as much time and energy as you’re willing to give.

As one busy professional put it: “It used to consume my evenings and weekends.”

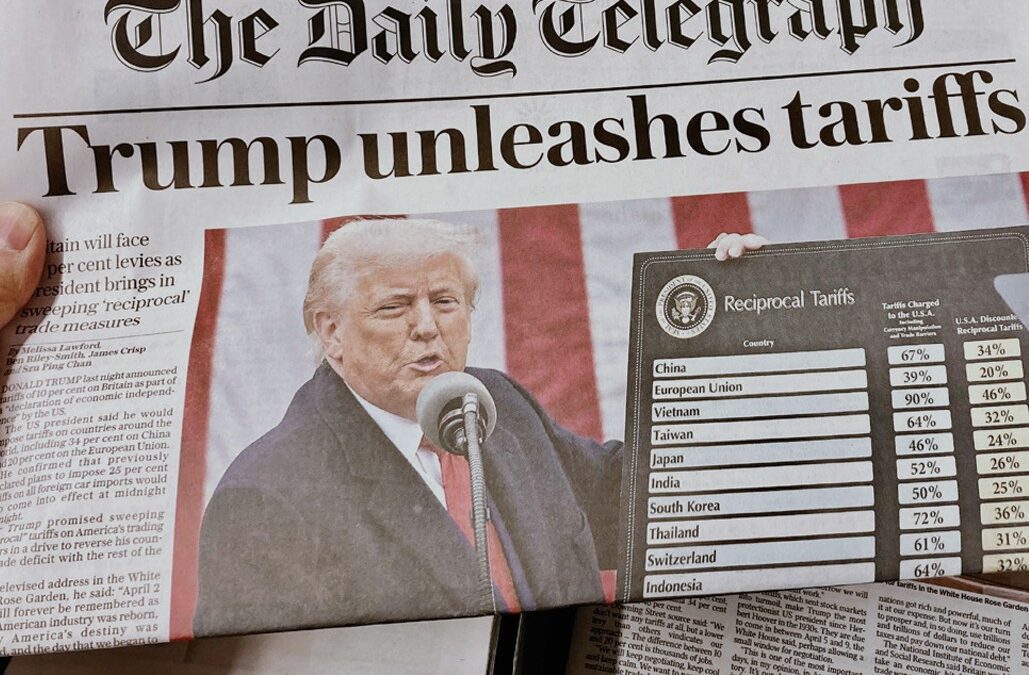

With recent tariff threats stirring fresh market turbulence, that gravitational pull can feel even stronger.

But it doesn’t have to be that way.

With a disciplined strategy, a long-term perspective, and a commitment to staying the course through volatility, investors can avoid being consumed by day-to-day noise — and instead focus on building real wealth over time.

Nobel Prize-winning economist Paul Samuelson once offered a timeless piece of advice that feels especially relevant today:

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

Amid today’s market jitters — sparked by tariff announcements and geopolitical tensions — Samuelson’s wisdom reminds us that short-term noise should not distract long-term investors.

Samuelson isn’t alone.

Eugene Fama, another Nobel laureate and pioneer of the Efficient Market Hypothesis (EMH), argued that share prices already reflect all publicly available information. As Fama put it:

“For investment purposes, there are very few investors that shouldn’t behave as if markets are totally efficient.”

This research forms the foundation of evidence-based investing — the idea that:

-

Markets are generally fair and forward-looking.

-

Prices move based on unpredictable news, which no one can consistently forecast.

Recent market volatility — driven by daily news shifts — only reinforces these principles.

No matter the conditions, the implications for investors are profound:

Key Takeaways for Long-Term Investors:

- Market prices are the best indicators of value.

Trying to outguess them — especially in reaction to headlines — is rarely a winning strategy. - Market timing is costly and ineffective.

Paying fund managers to predict market moves often leads to underperformance, particularly after fees. - Focus on long-term goals, not short-term volatility.

Obsessing over daily market swings distracts from the bigger picture: building lasting wealth aligned with your financial objectives.

The Freedom of an Evidence-Based Approach

The investment approach championed by Professors Samuelson and Fama offers investors something rare: peace of mind.

With this philosophy, you don’t need to take urgent calls from brokers, obsess over every headline, or scramble when markets dip on news like tariff threats.

And they are not alone.

Nobel laureate Richard Thaler (2017) shared a similar sentiment:

“Whenever anyone asks me for investment advice, I tell them to buy a diversified portfolio heavily tilted toward shares, especially if they are young, and then scrupulously avoid reading anything in the newspaper aside from the sports section.”

Daniel Kahneman, another Nobel Prize winner (2002), echoed this approach:

“If owning shares is a long-term project for you, following their changes constantly is a very bad idea.”

The advice from these four Nobel laureates is strikingly consistent: Ignore the short-term noise. Focus on what truly matters.

What You Should Focus On

While markets will always be unpredictable, the key to successful investing is to focus your energy where it counts:

building and maintaining a clear, personalized financial strategy.

A strong strategy includes:

- Defining your financial goals — whether that’s achieving financial independence, early retirement, or helping fund your children’s education.

- Assessing your current financial position — including your assets, income, savings habits, and risk appetite.

- Sticking to a realistic, disciplined plan — one that aligns with your goals, risk tolerance, and time horizon.

This clarity empowers you to tune out the daily market drama and stay focused on your life and career.

️ Keeping Your Strategy on Track

Of course, both life and markets can change.

That’s why regular strategy reviews are crucial — not to react to every headline, but to make thoughtful adjustments when necessary.

This could mean:

- Increasing your savings rate,

- Rebalancing your risk exposure, or

- Simply staying the course through turbulent times.

Another key to long-term success is keeping your portfolio efficient:

Taking advantage of better investment products over time — through lower fees, better diversification, or smarter tax structures — can often add more value than trying to “beat the market” during volatile periods.

The Bottom Line

Markets will rise, and markets will fall. But sound investing doesn’t need to be stressful or time-consuming.

With the right strategy and advice, you can build lasting wealth without getting caught up in the constant drama of daily headline.