by Richard Renfrew | Nov 21, 2025 | Financial advice

New Zealanders now lose an estimated $3 billion NZD to scams every year — that’s roughly 1.2% of our entire GDP According to the 2025 “State of Scams in NZ” report by Netsafe and the Global Anti-Scam Alliance, reported losses have skyrocked: 2022: ~$20...

by Richard Renfrew | Nov 5, 2025 | Investing

Written by: Richard W Renfrew (Financial Adviser) Signs Pointing to a Bubble Valuation Surge: AI-related companies have seen valuations skyrocket, often far beyond their current earnings or proven business models. Speculative Spending: Trillions are being...

by Richard Renfrew | Nov 5, 2025 | Investing

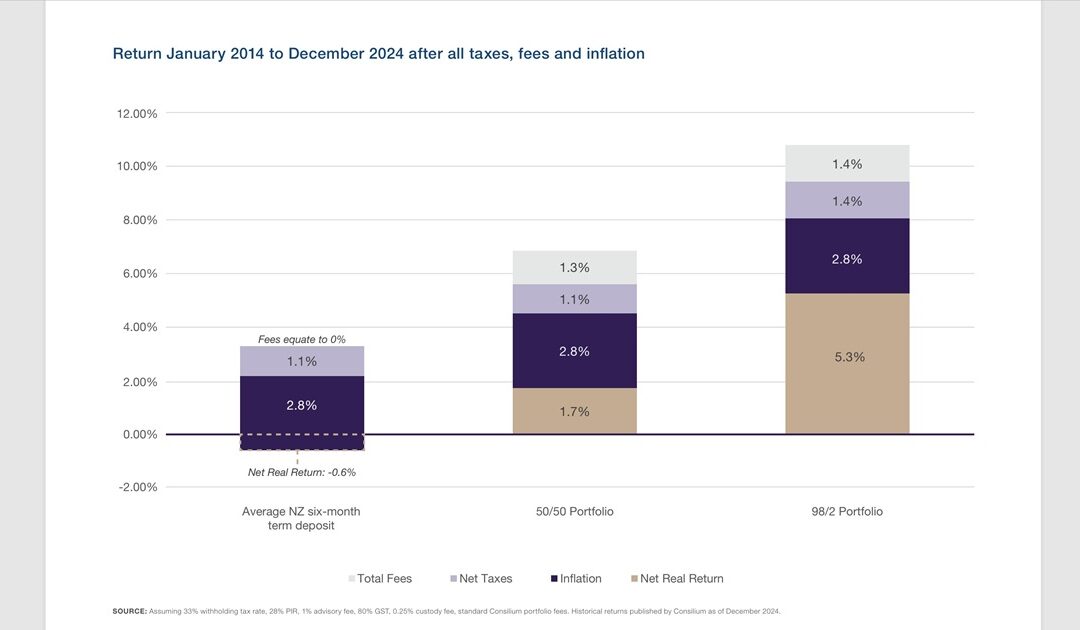

Have you considered how much money you are losing by having your money in term deposits? Over the last 10-years ending December 2024 the average return on a 6-month bank term deposit in New Zealand was 3.3% per year. That’s 3.3% before tax and inflation. Over the same...

by Richard Renfrew | Nov 4, 2025 | Newsletter - Quarterly

Lyfords quarterly newsletter reviews key financial market events that have impacted portfolio returns. Each quarter we have an article on a financial issue we believe will interest our clients. In addition we often post news updates and blogs on our web site at...

by Richard Renfrew | Jul 4, 2025 | Newsletter - Quarterly

Lyfords quarterly newsletter reviews key financial market events that have impacted portfolio returns. Each quarter we have an article on a financial issue we believe will interest our clients. In addition we often post news updates and blogs on our web site at...

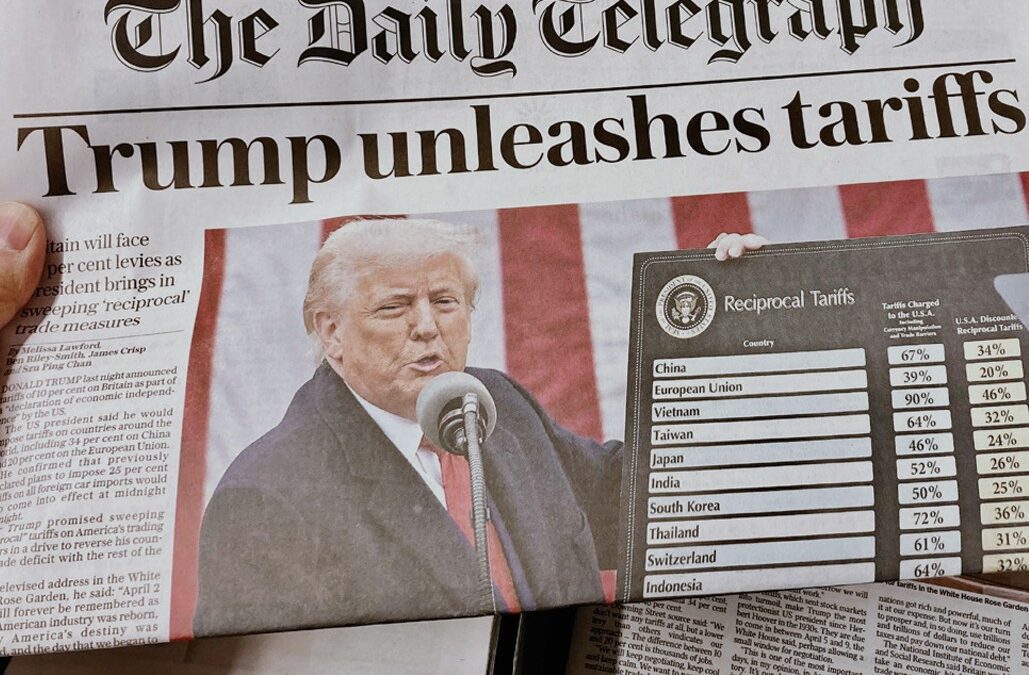

by Richard Renfrew | Apr 27, 2025 | Newsletter - Quarterly

Consilium recently cracked through the $9 billion in funds under management (FUM) mark, cementing its position as one of New Zealand’s fastest-growing investment platforms. Managing director Scott Alman says this milestone highlights the increasing demand for...

by Richard Renfrew | Apr 27, 2025 | Investing

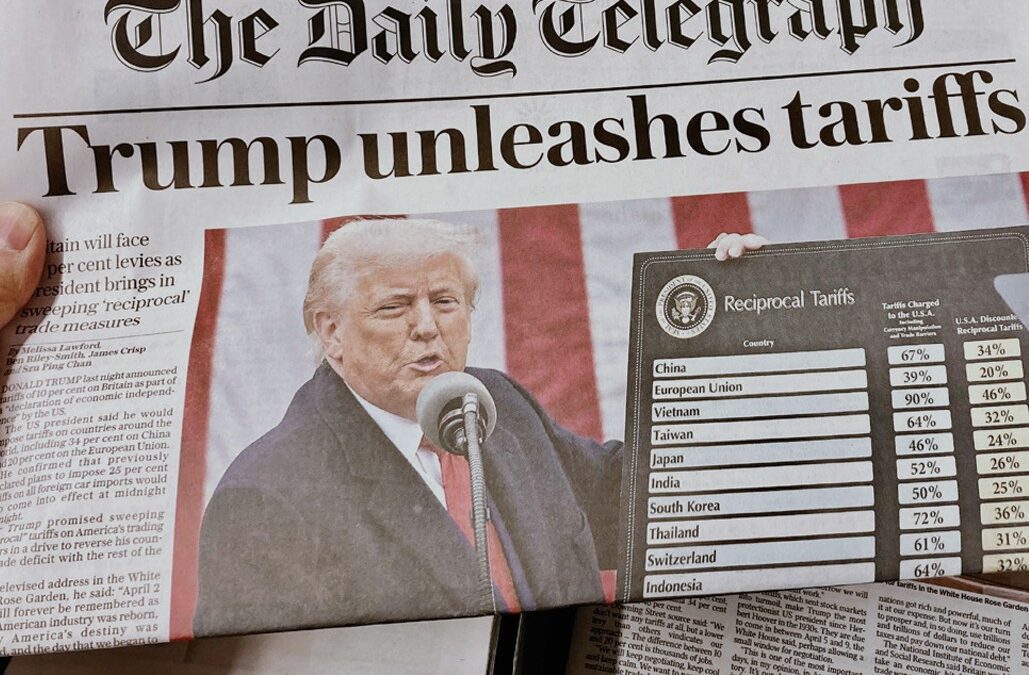

Investing can sometimes feel like a black hole, pulling in as much time and energy as you’re willing to give. As one busy professional put it: “It used to consume my evenings and weekends.” With recent tariff threats stirring fresh market turbulence, that...

by Richard Renfrew | Sep 6, 2024 | Investing

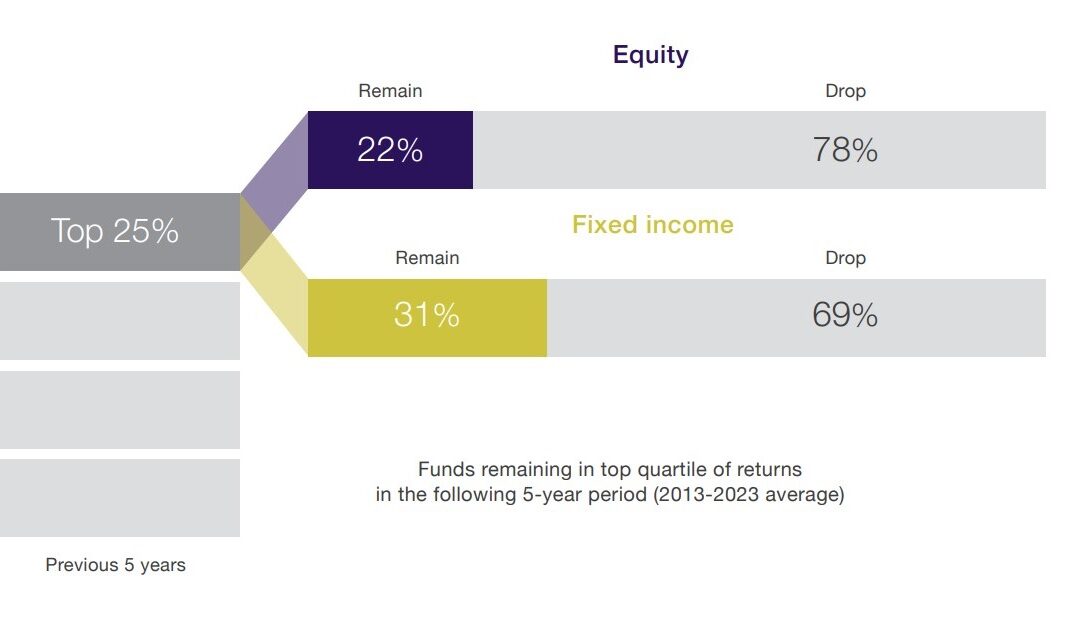

The chart shows the percentage of top-ranked funds that remained on top after 5 years. You might think that selecting investments based on past performance might continue to deliver the best performance. Research shows that most funds ranked in the top 25% based on...

by Richard Renfrew | Sep 5, 2024 | Investing

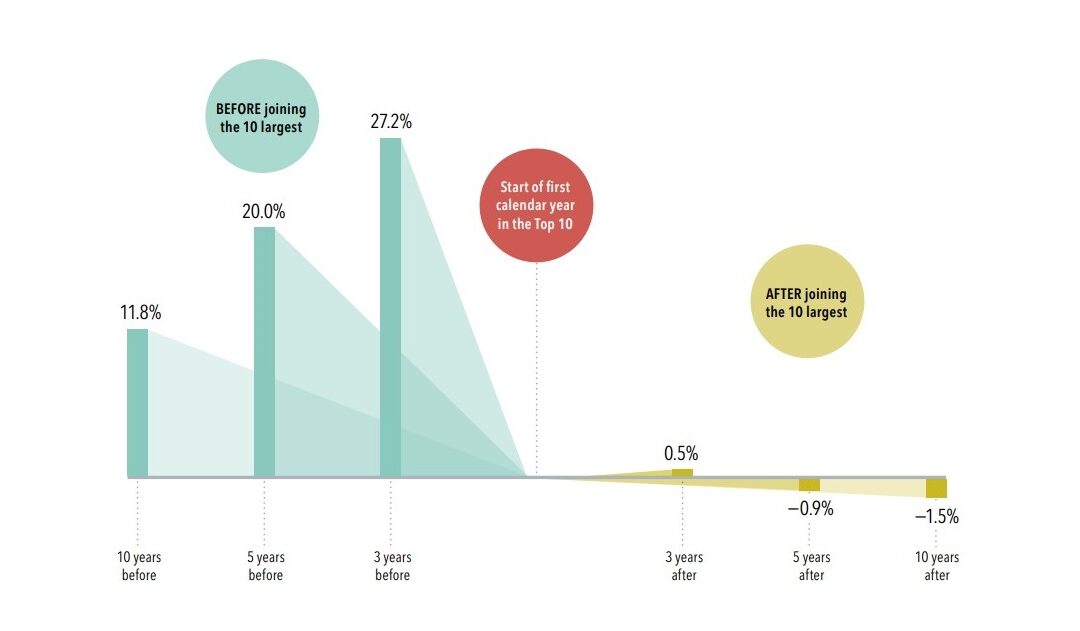

The chart shows the average annualised outperformance of companies before and after they entered the Top 10 shares on the US share market. The ‘Magnificent Seven’ refers to the high performing tech shares Alphabet (formerly Google), Amazon, Apple, Meta...

by Richard Renfrew | Sep 5, 2024 | Investing

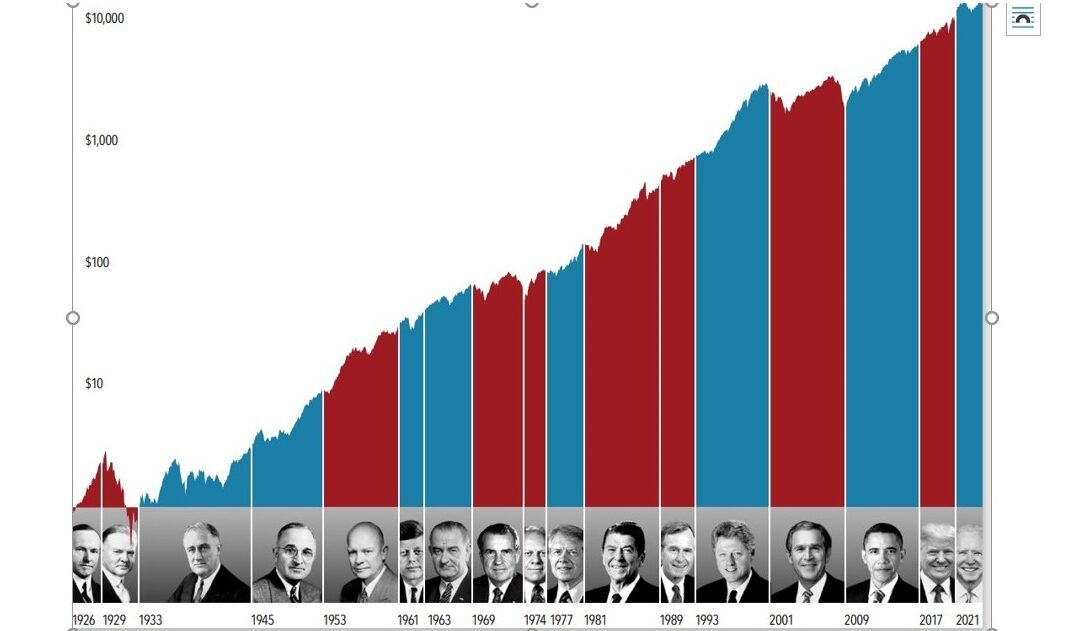

Looking at the evidence of how US Presidential terms have affected US share markets its evident that the outcome of an election is only one of many inputs affecting share markets. What the chart shows is that there is a consistent upward trend regardless of the...

by Richard Renfrew | Jun 19, 2024 | Investing

Prior to April this year (2024) retained income in Family Trusts was taxed at 33%. After April retained income over $10,000 will now be taxed at 39%. NOTE: Income that is paid out to beneficiaries before the end of each tax year will still be taxed at the...

by Richard Renfrew | Apr 27, 2024 | Newsletter - Quarterly

Lyfords quarterly newsletter reviews key financial market events that have impacted portfolio returns. Each quarter we have an article on a financial issue we believe will interest our clients. In addition we often post news updates and blogs on our web site at...