by Richard Renfrew | Apr 20, 2023 | Newsletter - Quarterly

Lyfords quarterly newsletter reviews key financial market events that have impacted portfolio returns. Each quarter we have an article on a financial issue we believe will interest our clients. In addition we often post news updates and blogs on our web site at...

by Richard Renfrew | Apr 16, 2023 | Property

With the changes around the interest deductibility of loans for rental properties are they still an attractive form of investment? In the past the rule has always been; if a loan is made to buy a taxable income stream, such as a share portfolio, rental property, or a...

by Richard Renfrew | Apr 13, 2023 | Financial advice

An area of our web site that is under utilised is our financial calculators. There are 11 calculators under the ‘Calculators’ tab. Richard originally developed these when he was in hospital following a ski accident and in was in traction for 10 days back...

by Richard Renfrew | Mar 14, 2023 | Investing

The Big Mac Index is a humorous yet widely used economic indicator that measures the purchasing power parity (PPP) between different currencies. It was created by The Economist magazine in 1986 as a way to make international economics more understandable to readers....

by Richard Renfrew | Mar 14, 2023 | Investing

Silicon Valley Bank – minimal portfolio exposure Two US banks, Silicon Valley Bank and Signature Bank, have gone into a government-controlled wind down. Silicon Valley Bank was among the largest 20 US banks and was affected by the loss of value of their bonds as...

by Richard Renfrew | Feb 20, 2023 | Financial advice, Investing

In the news this month the sharp share price declines of My Food Bag and Laybuy, are a reminder of the risk of investing into individual shares and that diversification is your friend. Laybuy (a NZ company) listed on the Australian stock exchange in September 2020....

by Richard Renfrew | Feb 5, 2023 | Retirement

What do you need to consider? Updated February 2023 There are over 48,000 residents in over 450 retirement villages in New Zealand. The number is increasing each year with our aging population. This is big business and is very profitable. The six largest Retirement...

by Richard Renfrew | Jan 31, 2023 | Investing

Last year was a difficult year for share and bond markets. Markets were negatively impacted by Reserve Banks across the world sharply increasing interest rates to combat inflation. There was also the negative impact of the Ukraine war (on oil and food prices) and...

by Richard Renfrew | Jan 31, 2023 | Investing

What are Smart Beta Funds? Smart beta investing is an investment strategy that seeks to capture market returns while also outperforming traditional market capitalization-weighted index funds. It achieves this by using alternative weighting methods that differ from the...

by Richard Renfrew | Nov 22, 2022 | Investing

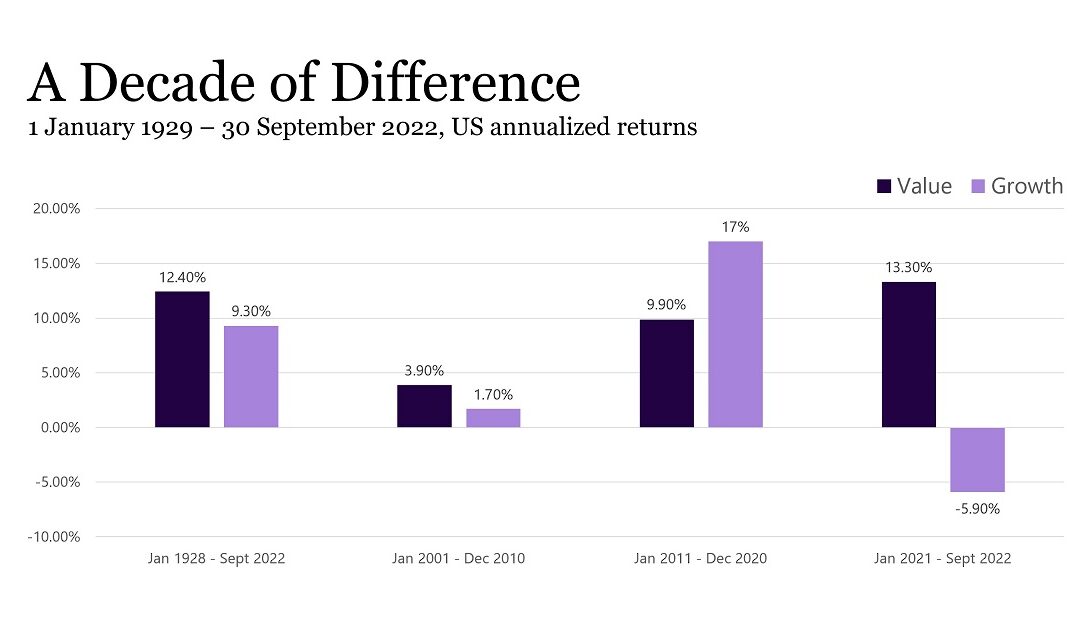

Let’s look at the evidence why the portfolios we recommend have a tilt to value shares. Value shares, are shares that trade at a lower price relative to fundamentals such as dividends, earnings etc. Growth shares are shares that have the potential to grow above...

by Richard Renfrew | Oct 31, 2022 | Financial advice

The following article is from Dimensional Fund Advisors The pandemic showed the power of a previously unknown virus to spread through the global population, threating health and creating economic mayhem. But few people appreciate the power of bad information to go...

by Richard Renfrew | Oct 18, 2022 | Investing

Long-term investing versus speculative investing is very much about having patience and riding out the highs and lows and not missing the best performing days. In our previous article on time in the markets versus timing the markets we looked at the S&P500 index...